Earlier this year I broke out some Kalecki to analyze where corporate profits were headed. The conclusion was rather simple – profits were likely to come under marginal pressure towards the end of the year but the risk of a large decline is unlikely.

Albert Edwards at Societe Generale has an excellent new report out describing why we might already be in a profits recession. In other words, forget the fiscal cliff. The profits cliff is already here:

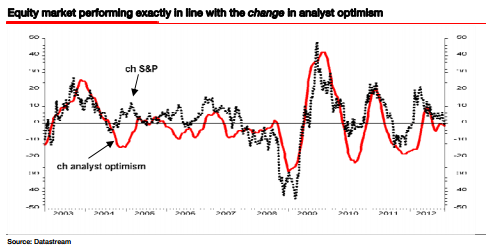

“We have previously highlighted that it is the change in analyst optimism (rather than the level), that seems to determine the change in the equity market (see chart below). With the change in optimism turning down, this helps to explain the weakness in the market since its July peak.

Regular readers will know that the IBES global aggregates data we use for the above charts is monthly, but my colleague Andrew Lapthorne aggregates up the weekly profits data from the stock level and publishes these in Global Market Arithmetic every Monday. His latest report this Monday had some very interesting observations.

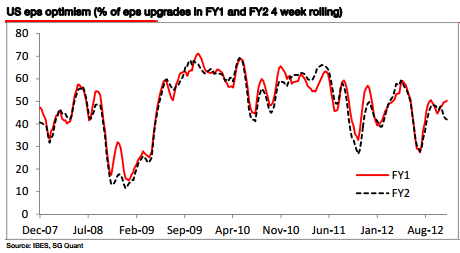

He said “the outlook for earnings has been extremely poor in recent weeks. Yes, the US reporting season led to an improvement in near term (2012) earnings forecasts with the ratio of upgrades to total estimate changes for 2012 earnings rising from 44% to 50% over the past month, but earnings momentum for 2013 has slumped, dropping from 48% to 42%, leading to a major divergence between the two (see left-hand chart below – we contrast the US divergence with that of Europe). For earnings momentum to collapse during a reporting season is highly unusual, as optimistic forecasts are generally reeled in over the period between reporting seasons.”

He continues, Consensus earnings growth expectations remain optimistic for next year with profits forecast to rebound globally by 12.4%. This is not particularly unusual at this stage of the year, with next year’s earnings almost always forecast to grow and with the expansion in growth often the result of Year 2 forecasts being downgraded at a slower rate to Year 1 forecasts, i.e. base rate effects. The question is not the level of earnings growth, but the rate at which earnings are being downgraded, and currently with global earnings momentum down in the low forties, it suggests we are already in a profit recession” (See Global Market Arithmetic link).

Andys comment about the unusual divergence between FY1 and FY2 profits optimism cannot be fully appreciated from the chart above that appeared in the Market Arithmetic. I therefore asked our colleague Rui Antunes to show a longer time series for these data. Now we can see

just how unprecedented this divergence is (see chart below).So it seems that while most commentators are worrying about an impending fiscal cliff, we have actually already stepped off the profits cliff. The recent decline in the equity market is more reflective of the dreadful profits backdrop than the upbeat economic data. The last time we saw this divergence between the market and the data (mid-2008), the economy had already slipped into recession some six months earlier. That is where I believe we are now. As we move into next year, expect the combination of poor profits and poor economic data to prove toxic.”

Source: Societe Generale

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.