Well, Greece just got very interesting. The Greeks voted no pretty decisively in the referendum today. Here’s what that means:

- The Greeks reject the terms of the Euro bailout.

- Syriza and Tsipras will go back to the negotiating table emboldened.

This is where things get very tricky. We don’t know how soon a deal could be negotiated and we don’t even know if a deal CAN be negotiated. Both sides seem too far apart as of last week to get anything done. All the referendum seems to have done is emboldened Tsipras into believing that this improves his bargaining power when it’s not clear whether that’s the case.

The strangest part about everything going on here is that the Bundesbank, I mean, the ECB, a supposedly independent Central Bank, has become the focal political point. When the ECB decided to stop providing emergency funding to the Greek banking system they acted in a manner that should be against any Central Bank’s mandate. As the implicit Greek Central Bank the ECB is there to ensure that the Greek banking system operates smoothly. Instead, in the last 2 weeks it has been used as a political tool that is now contributing to economic problems in Greece. We should be very clear about this. If the Greek banking system collapses and substantial contagion results it will be, in large part, because the ECB poured fuel on the fire. It’s amazing to me, that, after Lehman Brothers, a Central Bank could act so irresponsibly and simply stop providing emergency funding to a banking system in desperate need of it.

So that’s where we sit at present. Will the referendum lead to new bailout terms? And will the ECB backstop the Greek banking system in the coming weeks? If the answer to both is no then the Greeks will almost certainly leave the Euro. They cannot operate without a new bailout inside the Euro and the collapse of the banking system is going to force a new currency creation so that they can utilize the Greek Central Bank to backstop the banks.

If the answer is yes to both then we’re back to some version of where we were just a few weeks ago before all of this started and we will all go on about our lives until this issue comes up again later this year or in 2016 (because it doesn’t solve the EMU’s operational flaw). After all, there will ALWAYS be a “Greece” inside of the common currency system. That is, given the amount of intra-currency trade, there is always going to be highly indebted current account deficit countries on the other side of the core’s current account surpluses. Kicking countries out will make the problem go away temporarily before it grows into a different form in different countries. So, forcing Greece out is near sighted and, in my opinion, a pointless precedent.

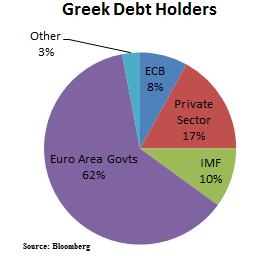

More importantly, a Grexit isn’t going to destroy the global economy. This is a remarkably small economy at just 2% of Euro Area output and roughly the size of Louisiana. Further, their debt is relatively small and is now held mostly by other sovereigns. I assume the ECB will react proactively and responsibly to avoid contagion. So, it’s not all that rational to assume that this is some version of Lehman Brothers 2.0.

On the other hand, Grexit will be very messy as it increases the odds of other countries leaving the Euro. As I’ve described previously, the really scary outcome here is not Grexit, but the potential for other exits. At the aggregate level we know that the common currency will always cause a “Greece”. So, without some form of transfer mechanism inside the Euro system this is a problem that will recur periodically in the coming years. Letting countries leave or kicking them out does not solve an inevitable result of the currency system’s construction.

So, the financial markets now sit in the hands of politicians and a politically compromised “independent” (haha) Central Bank. Wonderful. Here’s to hoping that European leaders can come to their senses, accept the inevitability of “Greeces” within the Euro and move towards a more sensible resolution than defaults and defections.

PS – In other news, the USA women’s soccer team is up 4-0 in the Women’s World Cup so the inverse correlation betweeen the Greek debt crisis and its impact on America seems to be strongly intact.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.