As May rolls around you’re bound to hear an endless number of pundits and market participants discussing the “sell in May” phenomenon. CXO Advisory has an excellent data analysis of the sell in May theory. In short, buy and hold beats “sell in May”. So maybe we can all move past this silly seasonal pattern that adds little value to portfolios and seems to be nothing more than a regurgitated media story.

Here’s CXO:

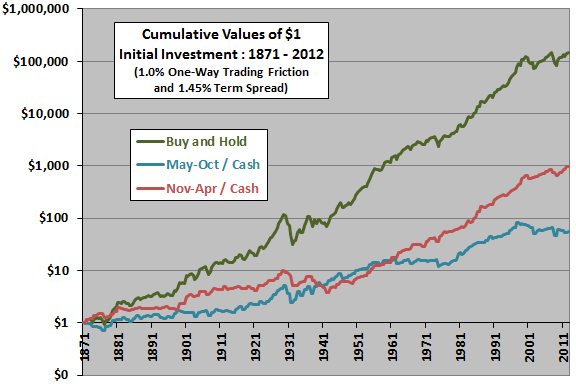

The following chart compares on a logarithmic scale cumulative values of $1.00 initial investments for three strategies using baseline assumptions over the entire sample period:

- Buy and hold stocks.

- In stocks (cash) during May-October (November-April).

- In stocks (cash) during November-April (May-October).

In support of conventional wisdom, being in stock during November-April mostly beats being in stocks during May-October (terminal values $965 versus $55). However, buying and holding the index substantially outperforms both seasonal strategies.

For another perspective, we compare average six-month return statistics for the strategies.

In summary, evidence from crude modeling over the long run suggests that stocks mostly do better during November-April than during May-October, but (with reasonable assumptions about return on cash, dividends and trading frictions) buying and holding stocks generally outperforms a “Sell in May” market timing strategy.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.