A strange thing has happened ever since the “tapering” began last December – interest rates have fallen, stocks have risen and inflation expectations have actually increased. This is almost exactly the opposite of what many people might have expected. After all, if “tapering is tightening” and QE is “money printing” then something doesn’t add up here because stocks should have fallen and inflation expectations should have declined. But when we look at the operational realities of QE it becomes clear that “tapering” really isn’t “tightening” in any meaningful sense.

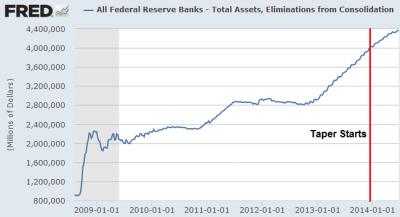

As you can see in the chart below, the Fed really hasn’t started tightening in any meaningful sense. In fact, their balance sheet is still expanding quite rapidly. So, as I explained early last year, if we want to call QE “money printing” then tapering is really just “less money printing”. Of course, that’s not how I view QE at all (see my QE primer here), but if you want to remain consistent with the mainstream view of things then that’s one way to view the tapering.

Perhaps more importantly, the stock market doesn’t even perform poorly during the early phases of a tightening. And the logic behind that is rather simple – the Fed reacts to an improving economy and if the Fed isn’t even reducing their balance sheet then we’re not even at the point in the economic cycle where the Fed thinks tightening is necessary. And that means the economy is probably still too weak to warrant a real tightening. And that, in a counterintuitive sort of way, is actually a good thing.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.