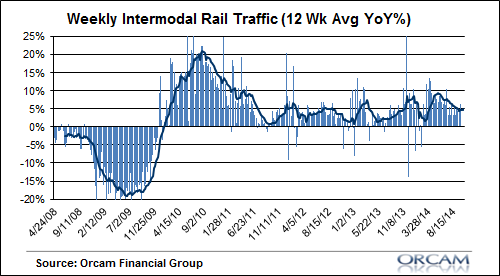

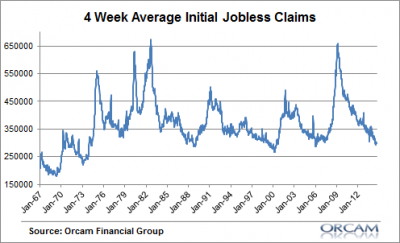

Just a quick update here on some of the near real-time economic indicators I track. Rail traffic and jobless claims are among the better macro indicators we see with some regularity. They’re obviously not a perfect reflection of the economy, but when taken in accordance with the broader picture they certainly help provide some clarity

The latest update on rail trends continues to show signs of modest expansion. The latest 12 week moving average comes in at 5% which is actually a healthier average rate than we’ve seen through most of the recovery. Granted, this is just one sliver of the economy, but it is certainly a positive sign (via AAR):

Weekly jobless claims continued their downward trend in recent weeks with the 4 week average dipping below 300K. This is generally consistent with a healing labor market and a clear sign that the US economy continues to move in the right direction.

All in all, this seems to confirm the “muddle through” macro view I’ve maintained for the last few years and these indicators look consistent with the other indicators I track more broadly….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

tealeaves

After Japan’s property bubble burst in 1990, their following recessions were the result of- externalities

– asian crisis bubble in 1997 asian crisis that popped when US started raising rates

– the 2000 dot com bubble which was popped with rising rates

– the 2007 with US property bubble also popped with rising rates

The final Japan recession occurred in 2011 after the earthquake/Tsunami.

We could speculate that without these externalities or black swan earthquakes, then maybe Japan could have avoided recession and grown very slowly. So why can’t the US somehow keep muddling along here low growth for months, or years or decades more until rising rates pops some bubble or a disastrous black swan jolts investment confidence.

tealeaves

Hypothesis: A nation in the aftermath of a balance sheet recession will have difficulty growing “fast enough” to boom and thus be less prone to subsequent busts (compared to the previous “normal/faster growing economy)

jswede

Claims mean practically nothing at this point in regards to unemployment – this study finds the main factor (75-80%) in UE at this point is the job-finding part of the equation… not the claims side.

“….Second, job separations themselves are poor

predictors of changes in the unemployment rate. When unemployment increases, it

may be because more workers are separating from their jobs and entering

unemployment or because currently unemployed workers are finding new jobs at a

lower rate. Work by a number of authors….has decomposed changes in the unemployment rate due to differences in the finding and separations rates and found that approximately 75 percent to 80 percent of these are due to changing job-finding rates. As a proxy for separations, initial UI claims is inherently a weak predictor of changes in unemployment.”

https://research.stlouisfed.org/publications/es/article/10199

LoLattheUS

If we’re going to pick data, might I suggest a metric that is reflective of people actually paying various taxes?

https://research.stlouisfed.org/fred2/series/EMRATIO

Factoring population growth, there has not been a statistical difference in that amount. The other factor is incomes in relation to those who still have a job. While taxation may be at all time highs, incomes are still below pre-2008. How long does that last?

https://data.bls.gov/timeseries/LNS11300000

Not seen since the 70’s, when women were just entering the workforce.

Carrying demand forward works out great for a while anyways, but I think where seeing the formation of a nice little dystopian society being created. How long will The People allow it? I don’t know. I do know that free lunches don’t last forever, and that indefinite growth is mathematically impossible – at least on this planet.

Andrea

Jobless claims where at a low point just before 2007. The graph also shows that low point in jobless claims tend to be associated with the end of an expansion cycle. This is on top of the fact that jobless claims are a poor indicator of true employment, since they do not consider the working population ratio nor the quality of jobs out there.

Robert Buttons

Baltic Dry index is down 48% YoY

Cullen Roche

BDI has never been a very good indicator of anything.

Cullen Roche

Man, so much negativity when I post something bullish. 🙂

jswede

to our defense, it’s been awhile since we’ve had the chance to debate the merits of Jobless Claims — even the bulls gave up on that long ago! 🙂

Robert Buttons

Sample bias. The bulls go happily through their lives, hanging out with their privileged pals at Whole Foods and Starbucks. The bears, who know the insane valuations are just that, stay up all night reading economics blogs.