If the market moves in cycles largely based around our psychology then we could be getting closer and closer to the point of euphoria. At least that’s what the price of ponies would tell us. With this weekend’s Kentucky Derby upon us, it’s interesting to note the latest from Jeff Kleintop of LPL who highlights the price of thoroughbred horses, an obvious luxury item whose price fluctuates with the strength of the economy:

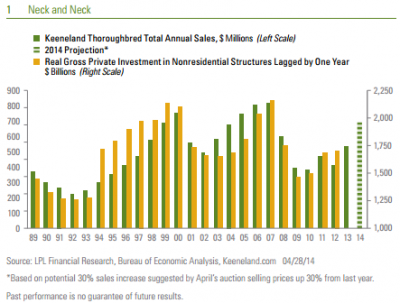

“Thoroughbreds are costly and speculative investments. The prices paid reflect the general willingness of horse owners to take risks. As a result, they are a good indicator of the strength of the economy. Sales of the leading thoroughbred horse auctioneer, Keeneland, fell during the recessions of 1990 – 91, 2001, and 2008 – 09, and then rebounded as conditions improved. The lingering weakness in thoroughbred sales over the past five years, 2009 – 2013, as they remained near levels seen 15 years earlier, coincided with a sluggish global growth environment, as can be seen in the similarly weak pace of business spending on new buildings to expand employees and output [Figure 1].

Fortunately, it seems that the risk-taking environment has recently changed and horse sales are bolting out of the gate this year. The median price of two-year-old thoroughbreds in training at this year’s April auction has broken out to a new all-time high of $200,000, up over 30% from last year, suggesting a new environment of risk taking by horse owners may be emerging.”

We’re not quite at new highs which may suggest that we’re not seeing the kind of extravagant spending that’s often consistent with excesses in the economy. That’s not terribly surprising given how sluggish the recovery has been. But we are beginning to see what looks like some signs of fragility in some of the more speculative markets. Bubble type fragility? Maybe pockets, but not widespread euphoria that would really frighten me.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.