The financial media is making a big fuss over the report that PIMCO is now short US Treasuries. This isn’t all that surprising given the firm’s incessant fear mongering about government default. Of course, that hasn’t stopped them from buying instruments backed by the full faith and credit of the USA (as they’ve been riding the coattails of the real bond guru Jeff Gundlach into MBS), but who needs facts when you can make headlines by giving the appearance that you are sympathetic to the fears of the common man?

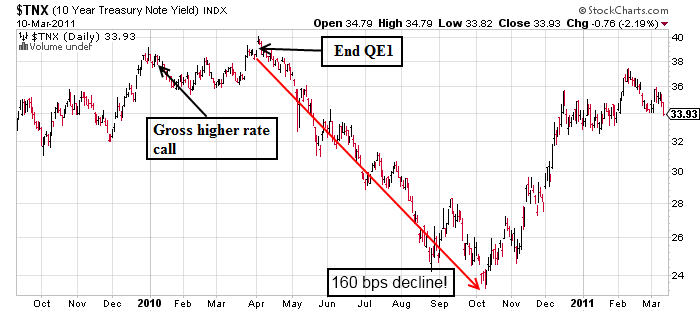

But more importantly, PIMCO’s big move is eerily reminiscent of QE1 when Bill Gross predicted surging yields. Of course, he top ticked the market to the day and yields immediately tanked. In early 2010 Gross said:

Won’t that (the end of QE1) put upward pressure on interest rates?

“I think it will. I mean, the mortgage market would be your first place to look, in terms of something that’s overvalued that would become normalized. Nobody knows what the Fed’s buying is worth — we think about half a percentage point on rates, but we don’t know.”

You sure didn’t know! Rates topped on the exact day QE1 ended. And if their timing is as good this time around, the battle ship of bond market firms might be moving out of the way of the torpedo just in time to confront the one coming in the other direction. In other words, one has to wonder, if Gross was so spectacularly wrong about QE1, why should anyone expect him to be right about QE2?

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.