Okay, that title’s just riffing off of David Beckworth’s recent post titled “Paul Krugman Will Not Like These Figures”. I really have no idea if Paul Krugman will actually like these figures. My guess is he’ll actually hate them because they’ll show why the declining deficit is creating downside risk to economic growth. But that’s just a guess.

Anyhow, earlier this week David Beckworth (whose work I think is excellent) posted a chart (in the link above) showing how fiscal contraction in the USA hasn’t actually resulted in a decline in nominal GDP. He’s right. But I don’t think the story is as simple as his post implies.

We focus a lot of time at Monetary Realism (also see here) on a multi-sectoral view of the economy. The entire focus of our equation S=I+(S-I) is to drive home the point that saving is more complex than simply saying “the government’s deficit is the non-government’s surplus”. Paul Krugman touched on this point earlier this year when he showed the chart below (see here). That meshed well with the work we do on S=I+(S-I) because it showed the substantial improvement in gross domestic private investment relative to gross private saving.

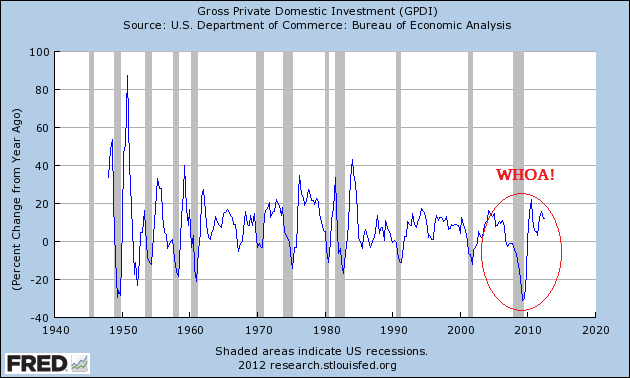

Now, if we view the economic picture as a whole, it’s not really that surprising that GDP hasn’t fallen off a cliff because understanding the current economic malaise is all about understanding how the government has been propping up a slowly healing private sector. Remember, private investment collapsed to horrific levels during this recession.

But it has slowly crawled back. I’ve described this as one of the main reasons why the USA is not headed for a Japan-style 20 year malaise. Or rather, we’re Japan “on fast forwards” as I like to say. The US business sector is actually pretty healthy. In fact, gross private domestic investment has registered 4 consecutive quarters of double digit growth so we’re seeing domestic investment pick up a lot of the economic slack that one might have expected to peel off as the deficit comes in a bit.

But I don’t think we’re ready to make a baton pass just yet from full public sector to private sector driven recovery. Yes, private investment is growing at a nice clip for now and we’re still running a deficit that is substantial (though lower than it was), but that doesn’t mean there’s no downside risk here. I think the economy remains extremely fragile and is still recovering from the consumer driven credit crisis. The balance sheet recession is still very much alive as the most recent NY Fed report on household credit showed. So a substantial decline in the government’s deficit could seriously impact aggregate demand and help contribute to a pullback at the consumer level. And if that were to happen we’d see that recovery in private investment turn south very quickly. And then our economy would start looking a lot more European….And then Paul Krugman would REALLY hate these figures.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.