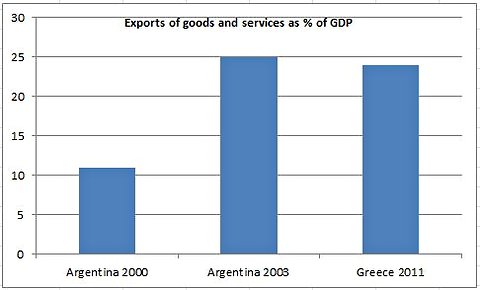

Paul Krugman has been discussing a potential return of the Drachma in Greece and how it would influence the domestic economy. Today he showed a nice parallel in Argentina and how exports are a much bigger part of the Greek economy than many presume:

Mark Weisbrot points out, in reference to my earlier post, that when comparing Argentina’s exit from the convertibility law with a possible Greek exit from the euro, the relevant comparison is with Argentine exports before the exit, not after. He’s right; here’s what it looks like (data from UN and Eurostat):

No one knows precisely how much the Drachma would fall compared to the Euro if it was reimplemented, but guesses are all over the place ranging from 20-80%. No matter what, the decline will be substantial. Substantial enough that that bar on the right-hand side of the above chart will spike higher. And if some of the more extreme guesses are right (like the 80% guess) then we’ll see something more than substantial on the export side as Greece becomes ultra competitive. And perhaps more importantly, Greece will start printing money again. And that means an end to the austerity and a double whammy on the growth side – domestic government spending stimulus AND a substantial boost in foreign trade. For a country in a depression that would almost certainly mean nothing but economic improvement from these levels. It would be nearly impossible NOT to see a growth boom – “boom” from current levels.

But the more interesting part to me is not Greece, but the other countries. Dr. Krugman is right about Greece and their export growth. But is he also right about the potential collapse of the Euro? If Greece leaves and begins to see economic improvement I think rumors will shortly begin about the other periphery countries also leaving. First Portugal, then Ireland, then Spain, then Italy. We’re talking about a big big mess there. It’s an every man for himself type of situation that is the exact opposite of why the Euro was created in the first place. The Euro would essentially become core Europe and something resembling the D-Mark. And a higher D-Mark on all these other countries is something that Germany doesn’t want because that means a big decline in their export driven growth (and maybe even a credit crisis for their banks).

So expect the line to hold here. Germany has the most to lose from a break-up. And my guess is they’ll start to do everything in their power to avoid a break-up because the worst case scenario will be a disaster for the one strong economy left using this currency. Greece might be able to leave at this point, but if that occurs the core needs to put up a firewall. If they don’t, this whole thing could blow-up in their faces….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.