Cliff Asness has some strong words for anyone who wants to say that Factor Investing doesn’t work. Basically, shut up, you’re wrong. In a post earlier this week he went into a wonky analysis showing that there appears to be a strong relationship between Fama’s various factors and market outperformance. I’ve been a bit vocal about my hesitance to embrace Factor Investing, but no, I will not shut up even if I am wrong!

If you’re not totally familiar with this discussion then here’s the 30 second rundown. Factor investing is derived from Gene Fama’s Efficient Market Hypothesis. Basically, Fama argued that you couldn’t outperform the market because all information is priced into markets “efficiently”. That is, there is one factor, beta, in the markets that tends to dominate performance and in order to generate better performance you had to lever up your level of risk. This theory didn’t make complete sense because there appeared to be some consistent methodologies that did outperform the market. The most pervasive were value investing (High book ratio Minus Low sometimes nerded up as HML) and small versus large stocks (sometimes nerded up as SMB or Small Minus Big). Fama accounted for these “factors” in his Three Factor Model and basically decreed them as laws of the financial universe.

Fischer Black, who would have won the Nobel Prize had he not died in 1995, was very critical of Fama’s findings. He even referred to them as “data mining”. As you likely know, I too am very critical of Fama’s views. I wouldn’t call them data mining though. I would just say they’re not very helpful for understanding the world as it exists today or tomorrow. But that’s a topic I’ve touched on in the past.

Here’s the thing about Factor Investing. In order for these strategies to be useful you have to be able to identity which factors will work at certain times in history because we know that they don’t always work. In my view, this is just active investing by another name (which is fine, if it works, since we’re all active investors). For instance, how many macro value investors have been misled by value indicators over the last 20 years? It’s widely known that almost every single value metric has been historically elevated since 1993. Buying value stocks in a basket has not led to strong performance. In fact, it’s led many prominent investors to be far more bearish than they should have been because they were essentially engaged in a form of historical optimization via backtesting. This led them to believe that the future must necessarily reflect the past and so 20 years of above average PE, PB, CAPE, HML, etc took them completely by surprise. In essence, they weren’t forward looking enough.

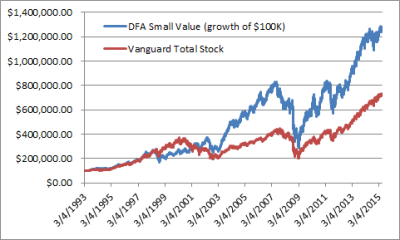

Conveniently, we have been able to put this to practice. After all, quant analysis is fun and all, but if it doesn’t work in the real world then we have a vacuum problem in finance (that is, our experiments in vacuums don’t translate to the real world which means they’re useless). DFA, which is the fund company that was founded utilizing Fama’s findings, has multiple funds that implement these approaches. Some of them seem to work and others seem not to. For instance, since 1993 when Black wrote his paper and value metrics appear to have become permanently elevated, DFA’s Small Value Funds have done nothing special.

Woah, that chart looks pretty great, eh? Not so fast. Although small cap value stocks have generated a superior nominal return since inception their risk adjusted returns have been nothing to write home about. Over this period the standard deviation of the Total Market is about 15.25 vs 19.6 for the small value segment. The Sharpe ratios are 0.50 vs 0.56. Statistically speaking, we’re not talking about anything all that special. If there’s some alpha in small cap value it appears to be meager at best. And I am being a bit generous here because the findings from DFA’s 1992 Small Cap Value fund are actually worse with a higher StDev and lower Sharpe (0.48). The worst part is that DFA sells their funds at a significant premium to Vanguard’s alternatives. So, one could argue that Fama (who is on the board at DFA) is guilty of profiting from the very thing he so often criticizes (“active” stock picking closet index funds).

Of course, my analysis here has its own data mining. The funds I have chosen are not a broad sample, but they do happen to be two of the longest real time experiments of these ideas. And they fail to generate the results that the academic work would have expected. That’s a big problem for factor investors who sell these ideas because once the real world experiments start failing broadly over long time periods then the credibility of the academic work is significantly diminished. Even if it’s not data mining it isn’t worth much to anyone looking to put these ideas to work in the real world.

In fairness, I love Cliff Asness and I think he runs some great funds. I’ve sent a good deal of money his way over the years mostly in his Risk Parity funds. In addition, my own approach is derived, in part, from Risk Parity so I’d be a hypocrite if I didn’t admit that he runs some very valuable funds. And I should be clear that I very much agree with Cliff that “active” investing works. In fact, I’ve argued that we’re all active investors which is a big part of why I criticize Fama’s work. But I remain deeply skeptical of the Factor Investing movement. It strikes me as various forms of beta investing that will work some times and won’t work at other times. And paying a premium to pick the right beta funds at the right times strikes me as something that isn’t a high probability endeavour.

Related:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.