If the “whisper number” for this week’s ISM Manufacturing report is correct then we can expect a disastrous report. According to LPL Financial the regional manufacturing reports are consistent with a contracting ISM figure:

Based on weakness in various regional ISM and Federal Reserve manufacturing sentiment surveys already released for August (Philly Fed, Empire State manufacturing, Richmond Fed, Dallas Fed), the consensus expects the August reading on the ISM to dip below 50 (to 48.5), from the 50.9 reading in July. The so-called “whisper number” among traders (who often informally have their own forecasts for key economic data and events that differs from the consensus estimate culled from economists) is probably closer to 44.0 or 45.0. Thus, expectations for ISM are quite low. A reading below 50 on the ISM has historically corresponded with contraction in the manufacturing sector, while a reading about 50 suggests an expanding manufacturing sector. The last time the ISM was below 50 was in July 2009, the first month of the current economic recovery.

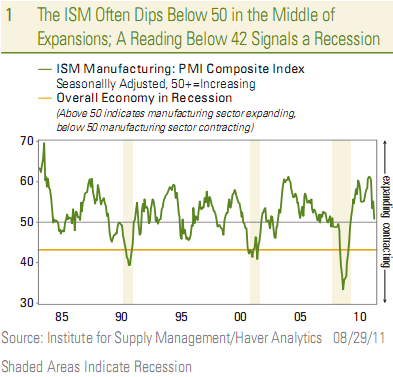

They warn, however, that it’s unwise to overreact to the negative number. As they show, it’s not unusual for the ISM to contract during an economic expansion:

As noted in Chart 1, it is not unusual to see the ISM to approach, and dip below, 50 in the midst of an economic expansion. The index dipped below 50 in the middle of the long 1982–1990 expansion and did several round trips above and below 50 in the 1991–2001 recovery, notably in 1995 and again in 1998. In the 2001–2007 expansion, the ISM dipped back toward the 50 level in 2004, before reaccelerating in 2005. More recently, we point out that manufacturing activity/output—vehicle production, industrial production, durable goods shipments and orders, manufacturing employment etc.,have held up much better than measures of manufacturing sentiment like the ISM and the regional Federal Reserve manufacturing indices.

As sustained reading of 42 or below indicates recession, and the ISM did get to that level in both the 1991 and 2001 recessions. It got as low as 33.3 at the worst of the 2007–2009 Great Recession.

Source: LPL

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.