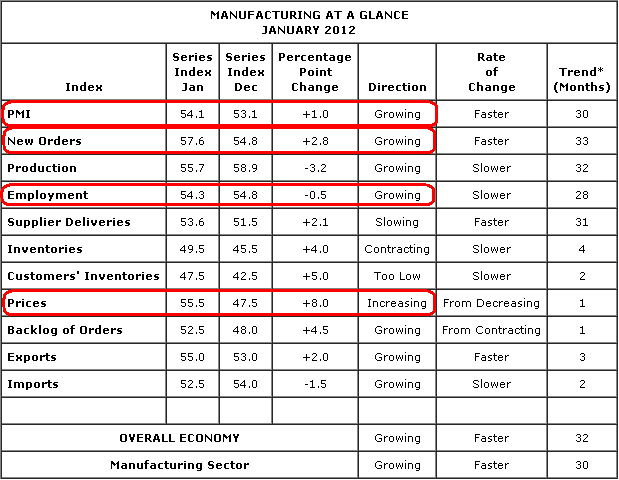

Another month of PMI data and another month of no recessionary signs. This month’s report was fairly strong overall except a continuing stagnation in employment. Headline came in at 54.1, well above the 50 range or expansion or contraction. New orders improved and prices jumped 8 points to 55.5 from 47.5. Comments from the survey were generally more upbeat:

- “Still seeing raw materials pricing moving down in general, but expect inflation later in the quarter.” (Chemical Products)

- “Year starting a little slow, but customers are positive about increased business in 2012.” (Machinery)

- “Once again, business continues to be strong.” (Paper Products)

- “Pricing remains in check with the demand we are seeing. Supplier deliveries are on time or early.” (Food, Beverage & Tobacco Products)

- “The economy seems to be slowly improving.” (Fabricated Metal Products)

- “Business lost to offshore is coming back.” (Computer & Electronic Products)

- “Business remains strong. Order intake is great — more than 20 percent above budget.” (Primary Metals)

- “Indications are that 2012 business environment will improve over 2011.” (Transportation Equipment)

- “Market conditions appear to be improving, with the outlook for 2012 better yet.” (Wood Products)

So no recession, but let’s not get overly excited here. The equity markets appear to be responding to the data with their now standard beginning of the month “the world isn’t ending” party, but it’s important not to get overly excited by this benign data. The key to a sustained and strong recovery remains employment and that is still the weak link in just about all the data.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.