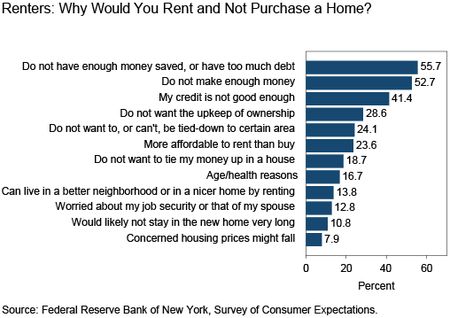

Here’s an interesting piece of research from the NY Fed that explains why the demand for housing remains relatively low – potential buyers just have too much debt and not enough income:

The recovery continues, but it remains lumpy due to the high levels of debt and the lack of strong income growth. The Balance Sheet Recession is ending, but it’s still having a lasting impact on the US economy….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

VerySeriousSam

“I already own a house” or maybe

“I already own a house, which is fully paid”

ist missing from the answers, no?

jswede

with all due respect and then some, I thought you declared the balance sheet recession over late 2013? At the time, I vehemently disagreed. Has something changed in your thinking?

Cullen Roche

The deleveraging ended in 2013. The level of debt is still problematic in some ways though….

jswede

balance sheet recession = deleveraging ?

we define it differently. the “level of debt” being “problematic” is at the core of my definition of bsr.

thanks for response.

JGF

Umm, no, because the first line indicates the question was to renters only.