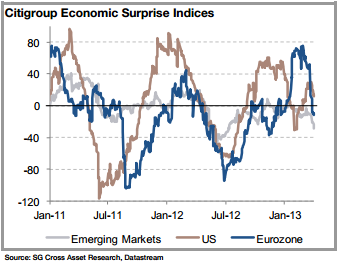

Just a brief update on global Citi Economic Surprise indices courtesy of Societe Generale. The general trend show a sharp weakening in European economic surprises which is the only index that has correlated well with equity market so far this year. Given the importance of psychology in price movements, it’s worth noting the potential risk of a negative surprise environment in which investors have potentially priced in a bit too much optimism.

Here’s SocGen with more thoughts:

- Turmoil in Cyprus is pushing the economic surprise index back into negative territory in the eurozone.

- Momentum is still declining in emerging markets as growth is slowing.

- Only the US is managing to maintain strong economic momentum and we expect economic surprises to remain positive over there, especially in H2 2013.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.