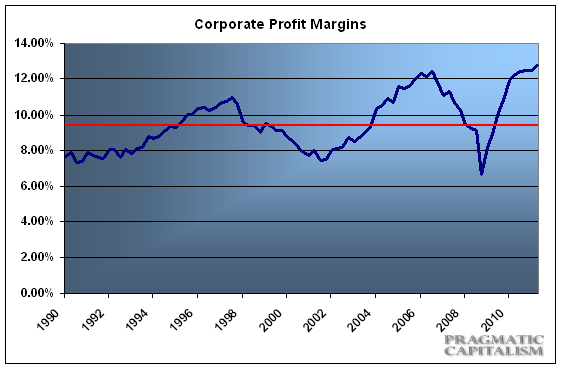

One story that has been lost in the endless Euro crisis is the strength in corporate earnings. This has been a conundrum in a world of slow growth and seemingly endless turmoil. But the truth is that the massive cost cutting from 2008-2010 has directly led to a surge in profit margins. Combine this with the global diversity of corporate America, tepid domestic growth and you have a situation where profits are actually performing pretty well.

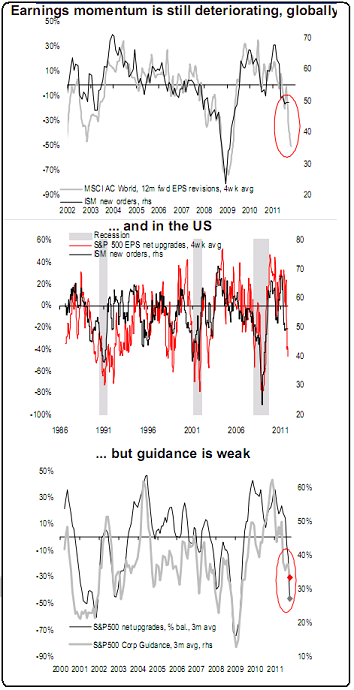

The picture is beginning to experience some fraying on the edges though. One data point that is consistent with my Expectation Ratio is the deterioration in forward guidance. As Credit Suisse recently noted, earnings momentum is deteriorating:

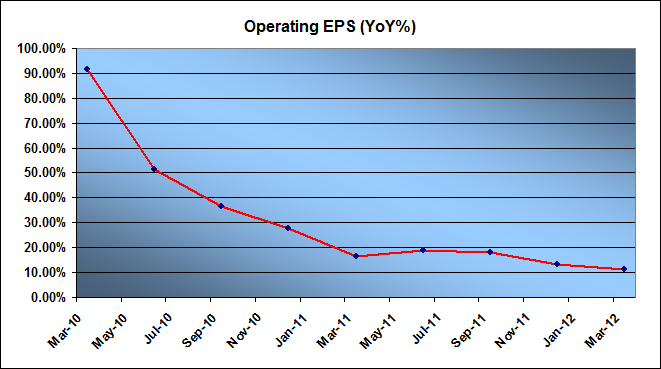

We can see a similar trend in overall operating EPS. Now, the early 2010 comps are versus the very low 2009 comps, but there is still a clear downtrend in the data. Q2 earnings are expected to see 11.1% YoY growth. Still very solid.

But the big question is, can record margins persist? With tepid domestic growth and a high risk of slowing international growth it’s not difficult to see how there could be downside risks to analyst’s outlooks. Jim Bianco thinks the downside to estimates could be as high as 20-40%:

“If the economy goes into recession, earnings forecasts are not 10% to 12% too high. Instead they might be 20% to 40% too high. In other words,if the economy goes into recession, the earnings forecasts are horribly wrong. “

The bottom line is: profits are hanging in there for now. But can the record high margins persist? While there might be no immediate danger of a serious decline in earnings, a basic understanding of mean reversion and historical earnings will show you that this environment is not sustainable. Unfortunately, timing the turn is not as easy to predict. I wish I knew. And if I did this research would be a lot more useful. The key of course is knowing what is coming down the tracks at you and being able to decipher the risks in a way that keep you from being run over by a potential oncoming train. While the future might be unpredictable, it is not unmanageable.

For now, I think we have to remain of the same outlook that I have maintained for the last 5 years. This unusual earnings environment only further confirms my long standing perspective that this is not a buy and hold market. Rather, one must remain nimble within the unusual environment known as the balance sheet recession. It won’t last forever, and in fact, the next trough in earnings and profit margins might just coincide with the end of this wretched recession….One can hope.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.