More good economic data this morning. We got our first real glimpse at Friday’s job’s report as the ADP reported a blowout figure. They reported 297,000 private sector jobs for December. The ADP report is notoriously volatile and has had some huge misses over the years so most analysts and market participants are skeptical of the report’s strength.

The Challenger Job’s Report also showed a sharp decline in layoffs as December came in at 32,000 versus last month’s jump of 48,700. Analysts are currently calling for 140,000 new job’s in the government’s report this Friday, but the sum of the data in recent days is mixed at best as both ISM reports point to weak hiring, but this morning’s data points to better than expected figures.

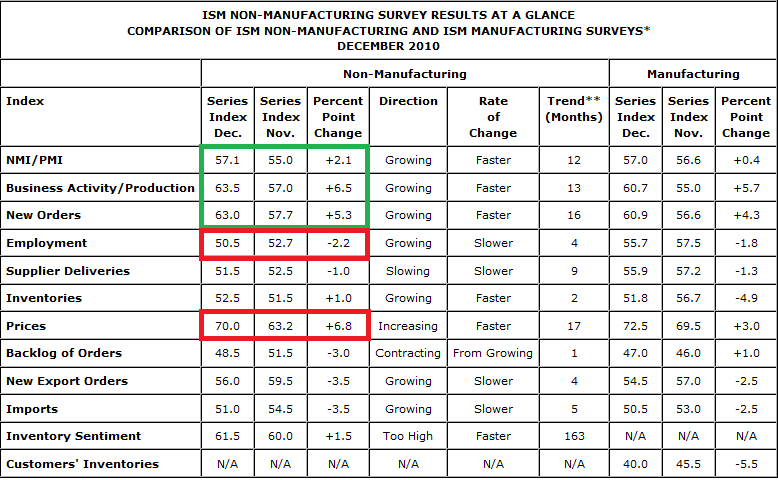

This morning’s non-manufacturing ISM report showed similar strength to Monday’s ISM report and the recent regional reports. Anthony Nieves Chair of the ISM elaborated on this morning’s report:

“The NMI (Non-Manufacturing Index) registered 57.1 percent in December, 2.1 percentage points higher than the 55 percent registered in November, and indicating continued growth in the non-manufacturing sector. The Non-Manufacturing Business Activity Index increased 6.5 percentage points to 63.5 percent, reflecting growth for the 13th consecutive month at a faster rate than in November. The New Orders Index increased 5.3 percentage points to 63 percent, and the Employment Index decreased 2.2 percentage points to 50.5 percent, indicating growth in employment for the fourth consecutive month, but at a slower rate. The Prices Index increased 6.8 percentage points to 70 percent, indicating that prices increased significantly in December. According to the NMI, 14 non-manufacturing industries reported growth in December. Respondents’ comments vary by company and industry, but overall are mostly positive about business conditions.”

Overall the report was very strong. Productivity and new orders showed strong gains, however, the decline in employment and jump in prices are alarming. All in all it was another day of good news. The US economy is clearly healing faster than most assume and we might be starting to see signs that should lead to real private sector job creation, which, would be the icing on the recovery cake.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.