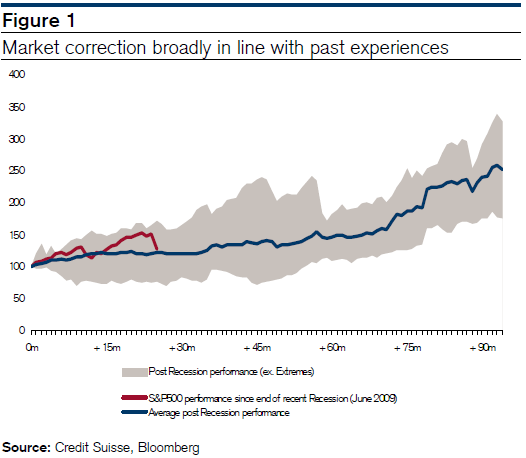

Credit Suisse says the recent action is nothing unusual in a post recession period. They maintain that the markets are declining right in-line with past recovery ranges and will look for a catalyst to continue their rally from here. They make the bull case:

“Now that the Q2 2011 earnings reporting season has ended, the equity market will focus on macroeconomic news, and sentiment is likely to remain the key driver for the next few weeks. While equity markets recovered somewhat last week and, we think that further catalysts will be needed for a more sustained and convincing recovery, either from policymakers or macroeconomic data, or ideally both. Specifically, from a macroeconomic standpoint, we would need to see macroeconomic data points to confirm that the recent weakening of economic indicators and growth numbers are indeed temporary in nature.

While the market correction over the past few weeks was quite intense and was caused by shocks such as the downgrading of the USA by S&P and the weaker-than expected ISM new orders figures, this correction should be considered in the context of an after-recession period, where corrections in generally upward trending equity markets are not unusual from a historical perspective. If we have seen the bottom, and assuming that we do not slip back into a recession (which is our scenario), and the historical analogy holds, we think that equities should perform well in the next 6 months.”

Source: Credit Suisse

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.