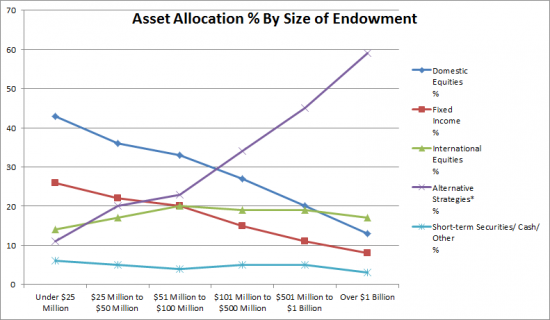

Here’s a pretty interesting data point that I came across from Value Walk. They cite the NACUBO study on endowment funds in 2013 and found that larger funds tend to have a propensity towards high allocations in “alternative strategies”. That includes hedge funds, absolute return, market neutral, long/short, 130/30, event-driven and derivatives; private capital, including private equity, international private equity, global venture capital and energy and natural resources; distressed debt; and private equity real estate.

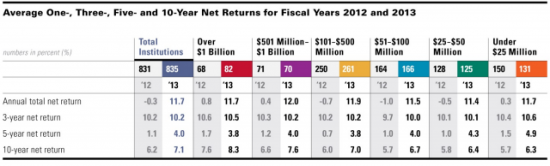

This is interesting from a performance perspective because a lot of these larger funds are moving into alternative strategies, which presumably charge much higher fees. That would lead one to conclude that the larger funds might also have a propensity to underperform. But that hasn’t been true as we can see in the figure below:

I hate to draw sweeping conclusions based on a narrow group of endowment funds, but this would seem to lend some credence to the idea that some people are probably overly zealous in their demonization of the benefits of alternative strategies in broader portfolio construction….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.