The smartest investors know that they’re actually not that smart. That is, they recognize the fact that they’re going to be wrong a lot. But in realizing this they also [ … ]

Category: Investment Strategy

More Thoughts on “Fad Investing”

In a recent post I called factor investing “fad investing” (see here) because it is, at its core, an ex-post view of the world that implies that the markets will [ … ]

Putting the Performance of Gold in Perspective

My comments about gold during the RT interview with Peter Schiff made a lot of people upset. I’ve received a number of emails, angry comments and forum posts. One of [ … ]

Some Thoughts on Risk Parity

This is a very good piece by Cliff Asness on his new blog. If you don’t follow it then add it. Cliff is one of the smartest dudes around. Anyhow, [ … ]

Assessing the Performance of “Passive” Indexers

I’ve raised a bit of a stink in recent weeks with my commentary on “passive indexing” so I figure I might as well keep stirring the pot here while it’s [ … ]

The End of Stock Picking

Jason Zweig has a nice piece in yesterday’s Wall Street Journal on the end of the stock picking asset manager. He notes: The debate about whether you should hire an “active” [ … ]

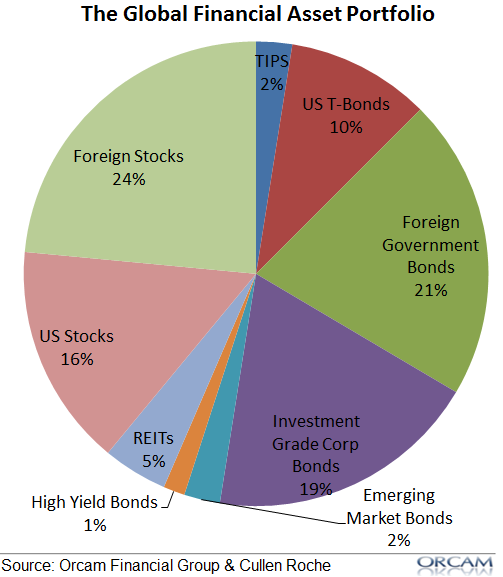

Is the Global Financial Asset Portfolio the Perfect Indexing Strategy?

* This is part 1 of this post. Please refer to this link for part 2. If there was such a thing as an indexing purist that person would [ … ]

More Thoughts on the CAPE and Valulations

I’ve made my opinion on valuations and the use of CAPE pretty clear – these sorts of metrics don’t tell us much about the macro environment because the whole idea [ … ]

The Ivy Leagues and Diworsification

Overcomplicating the portfolio construction process can be bad for your returns….