I was intrigued by comments in this interview with Marc Faber of the Gloom, Boom and Doom Report. He said: “I am hoping for the market to drop 40% so [ … ]

Category: Behavioral Finance

The Biggest Risk in 2014: Recency Bias

The biggest risk in 2014 is likely to be a common one – recency bias. Otherwise known as your own brain’s tendency to focus excessively on things that have only just occurred.

2013: the Year of Behavioral Finance

There were many big developments in 2013, but none stood out quite like the impact of behavioral finance. A few things made this the year of behavioral finance:

Leverage Causes Fat Tails and Clustered Volatility

Good paper here via quantivity on Twitter discussing the effect of fund managers borrowing on margin to purchase assets. This is something I’ve discussed previously in my many posts on margin [ … ]

The “Tuesday Rally” & Recency Bias….

If there’s one cognitive bias you have to be particularly aware of in the markets, it’s recency bias. Recency bias is the tendency to believe that what has just recently [ … ]

Being Right Isn’t the Only Thing That Matters

My real expertise is in portfolio construction and understanding the world of saving/investing. And as I’ve evolved and matured during my career I’ve been forced to become comfortable with one [ … ]

The Economy, The Stock Market & (More) Recency Bias

The stock market has really thrown everyone for a loop again this year. An article in the NY Times this weekend highlighted the fact that the global economy is very [ … ]

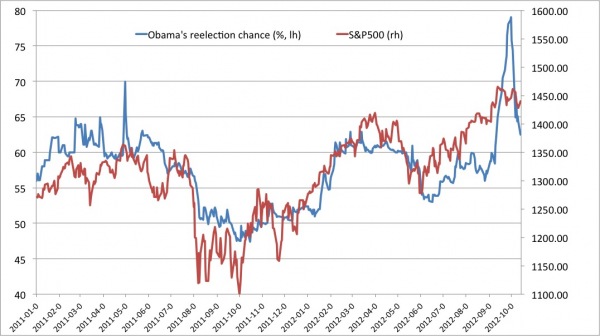

Stock Prices, Presidents and Recency Bias

I’m not sure whether to laugh, cry or throw this in the “dataming” bin. The chart below comes from Lars Christensen’s blog. It shows the S&P 500 vs the [ … ]

The Power of Fear

If you really want someone to act on something you have to invoke emotion. You have to give them a sense of urgency. If you can invoke emotion you substantially [ … ]