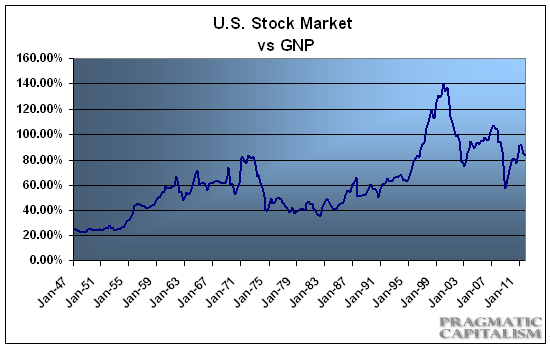

The most recent update to Warren Buffett’s favorite valuation metric is showing some fairly encouraging signs. For those who aren’t aware, Buffett is quoted saying that the total market cap vs GNP is one of his preferred valuation metrics. The current reading of 89% is still above his preferred buying range (70-80%), but well off the highs we’ve seen in the last 15 years. Buffett has previously explained his thinking behind the indicator:

“For me, the message of that chart is this: If the percentage relationship falls to the 70% or 80% area, buying stocks is likely to work very well for you. If the ratio approaches 200%–as it did in 1999 and a part of 2000– you are playing with fire.”

So stocks aren’t cheap, but they’re also not terribly expensive based on this measure. If the recent trend holds we could be nearing Buffett’s preferred buying range in the coming years….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.