I did a brief interview on Boom/Bust yesterday. We touched on a number of points:

- Why this economy deserves more respect than it’s getting. I explained how the recent recoveries are actually becoming longer and more stable than past recoveries. In essence, they’re becoming better “risk adjusted” recoveries. That shouldn’t be overlooked despite the fact that the headline growth is lower than we’re used to.

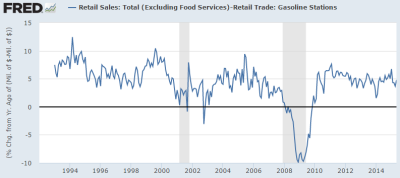

- Retail sales have been weak, but are largely the result of weak gas sales due to falling oil prices. You can see this in the following chart where I back out the impact of gas:

- We touched on the bond market, rising rates and why the Fed is likely to raise in 2016. In essence, they’re looking ahead at the potential of rising wages, rising year over year inflation comps and likely to get ahead of the curve there. This leaves long duration bonds in a precarious situation for the remainder of 2015.

- Housing faces several secular headwinds. The primary headwind is the lack of millennial buyers who are graduating with high levels of credit card and student loan debt and simply don’t want the burden of another debt contract. Housing will be increasingly dependent on foreign buyers and wealthy buyers.

The interview is attached. You’ll have to excuse my disheveled look. I was literally sitting in I-5 traffic two minutes before this. I walked into the studio, sat in the seat and started yapping. My ear piece wasn’t even in….Oops.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.