I’ve raised a bit of a stink in recent weeks with my commentary on “passive indexing” so I figure I might as well keep stirring the pot here while it’s boiling hot. Here is my main argument, in a nut shell:

- At the aggregate level there is only ONE portfolio of all outstanding financial assets (the global financial asset portfolio or GFAP). A truly “passive indexer” would not advocate picking assets inside of this portfolio. Instead, an indexing purist would simply take the return from this aggregate portfolio. Unfortunately, that portfolio doesn’t exist so no one can actually implement a truly “passive” approach.

- Because of the above reality we must all choose to allocate assets in some manner based on our risk tolerance, financial goals, etc. There are lots of reasons why one might deviate from the global aggregate portfolio, but no matter the reason, it renders us all “asset pickers” inside of a global aggregate.

- The above facts render the concept of “passive indexing” misleading to some degree since it distracts from the reality of necessarily and actively picking assets.

None of this should be controversial. And none of this should be misconstrued as an argument in favor of traditional mutual fund managers or what has traditionally been deemed “active” management. I am simply pointing out that even “passive indexers” are actually engaging in a form of active asset picking. In essence, we are all asset pickers.

To highlight this point I wanted to use an example. For instance, in one of the most widely cited “indexing” research pieces, Rick Ferri and Alex Benke show that most mutual funds don’t beat an indexing approach. This isn’t all that surprising. Most mutual funds are just closet indexers trying to pick assets inside of an aggregate like the S&P 500 while charging a high fee. But what’s interesting about the Ferri/Benke study is that they engage in a similar type of asset picking that they criticize fund managers for engaging in.

In the Ferri/Benke study they cite the timeframe from 1997-2012 and show that most mutual funds underperform various types of portfolios. But none of these portfolios represent the GFAP. They are all arbitrary ASSET PICKS deviating from the GFAP. For instance, in the first performance test Ferri/Benke arbitrarily pick a set of three funds comprised of 40% US equities, 20% international equities and 40% US bonds. Of course, this portfolio has a US biased focus and does not accurately reflect the allocation of the GFAP in 1997 when it was approximately 55% stocks (mostly foreign), 5% real estate, 15% non-government bonds and 25% government bonds.

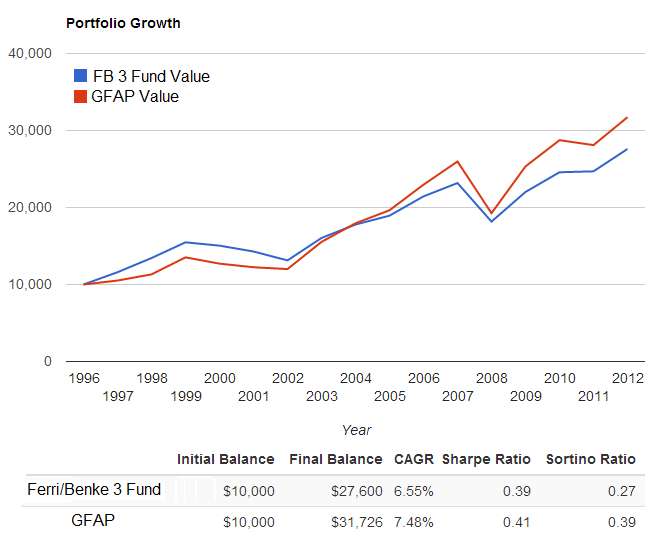

So, how do these portfolios compare over this period? Interestingly, the actively and arbitrarily selected Ferri/Benke “passive” portfolio underperforms the GFAP in both nominal terms as well as risk adjusted terms. They are guilty of precisely the same thing they’re criticizing the active managers of doing by actively picking assets inside of an aggregate and then underperforming that benchmark!

The performance of the Ferri and Benke asset picking is just as bad as the mutual fund managers they are criticizing. They underform by almost a full percentage point per year and generate worse risk adjusted returns than the GFAP. Plus, it should be assumed that they would charge you a fee for this service which would further reduce the nominal return.

The reason I find this so important is because I see lots of people advocating “passive” indexing claiming that they are something totally different from stock pickers or the active managers they often criticize. But the reality is that most of them are just a different form of “asset picker” or market “forecaster” deviating from the ultimate aggregate index, the GFAP. And in doing so they often underperform or construct portfolios that are nothing more than active bets on certain assets inside the aggregate. This is not much different than picking stocks inside an aggregate like the S&P 500 yet “passive” indexers perpetually berate “active” managers for engaging in an “active” endeavor without realizing that they are doing something very similar.

We should all care about this because there are some advisors trying to sell this idea of “passive indexing” while charging you a high fee for it. This is high fee asset management by another name. Further, we should be concerned about the way in which these people are going about their “asset picking”. While they might perform better than your average closet indexing mutual fund it does not mean that what they are doing is necessarily smart. It just means it’s better than something very bad (closet indexers).

Now, I am by no means advocating traditional “active” management or constructing an anti indexing argument. I am a proponent of using low fee indexing and maintaining a tax and fee efficient approach. But I think it’s important to remember the “Allocation Matters Most Hypothesis” before falling in love with an indexing strategy without understanding how “active” it really is.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Frederick

Cullen, thanks for this series of posts. It has been very educational.

John Daschbach

Following on my earlier comment regarding housing, the correct GFAP has to include all claims on future productivity including ones which are unknown and ones which are not considered liquid and thus perhaps not included in your view of the GFAP.

Here are a couple of edge cases which are nevertheless important in this context:

Water rights in the California Central Valley. These are very complex, subject to ongoing case and statutory law, and some hold value that is huge in some potential extended rainfall periods. If CA has a seriously extended low rainfall period (like we think hit the Anasazi a long time ago in the SW) then the real and financial value of some current asset rights will be huge. Yet this is not really a market most people think of in terms of GFAP.

The goodwill and other intangibles of perhaps millions of small businesses worldwide. These are not liquid assets but may comprise much of the real assets of a large part of the world.

There is no way we will ever have a GFAP, but the real GFAP is coupled, in complex ways, to what people think of as FA. Even in the financial world of reasonably liquid assets the coupling to the low liquidity world can be weak over some, perhaps extended, time periods.

The Passive Indexers are roughly making the assumption that relative changes in claims against real productivity are small. This doesn’t seem all that realistic.

Mark Stanford

This is a very good post. I never thought about things this way, but it’s funny to see that the “passive” indexing advocates are actually guilty of the same thing they accuse the active managers of doing.

Cullen Roche

When you approach things from an objective and unbiased perspective it allows you to see the world for what it is rather than the way that someone wants you to think it is. The idea that we are all active “asset pickers” should be obvious to everyone, but not everyone can think objectively….We tend to pick sides in debates. In this case, some people have rightly demonized high fee “active” managers, but in the process, overlooked the fact that most index fund advocates also advocate a form of active asset picking….

Mark Stanford

Yes, thanks.

You also forgot to mention in the post that an asset manager will charge you a fee to put together that three fund allocation. That usually takes off another 0.5%-1% per year.