There was no bigger story in the financial world in 2014 than the entry of the “Robo Advisors”, the automated investment services. I did a comprehensive review of these services earlier in 2014 and essentially concluded that they were Wall Street’s newest and slickest way to charge higher fees for something that wouldn’t beat a basic low fee index approach. Now that one year is officially in the books we can begin to assess how these Robo Advisors are doing and whether their claims about “better performance” and “additional returns” of up to “4.6%” are valid.

For simplicity, I took the two main Robo Advisors (Betterment and Wealthfront) and backtested their most aggressive taxable portfolios. For Betterment this results in a 100% stock portfolio and for WealthFront it results in a 90% stock, 5% commodity and 5% muni bond portfolio. The results for 2014 were not good and they certainly don’t come close to the exaggerated claims of adding up to 4.6% in “additional returns”. Unless your benchmark is high fee closet indexing mutual funds or cash, which is certainly not the correct way to benchmark anything….

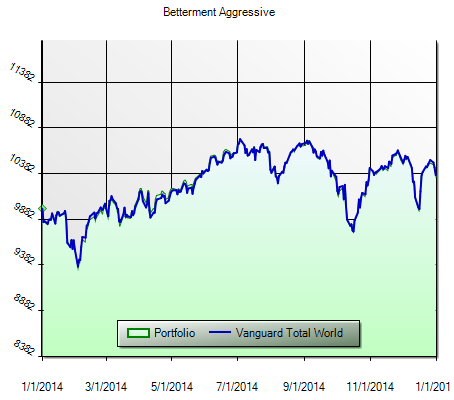

The Betterment Aggressive portfolio results in a portfolio that almost exactly mimics the Vanguard Total World Index. This isn’t surprising since they’re basically a 45% US stocks and 55% foreign index. The 12 month return of 3.43% was in-line with the Vanguard Total World Index, but significantly below the S&P 500 index and the Global Financial Asset Portfolio which generated returns of 13.46% and 5.85%. Relative to the S&P 500 the Betterment Aggressive portfolio actually took more risk (standard deviation of 13) than the S&P 500 (11.05) and generated a lower return. Therefore, the nominal return was lower than the S&P AND the risk adjusted returns were worse. The GFAP did about as well as the S&P on a risk adjusted basis with a standard deviation of just 5.17. In essence, Betterment’s Aggressive portfolio resulted in portfolio degradation and charged you a premium over a Vanguard Indexing account for it. Even worse, you could have achieved the same return with ONE simple fund as opposed to trying to implement the fancier looking 6 fund Betterment portfolio.

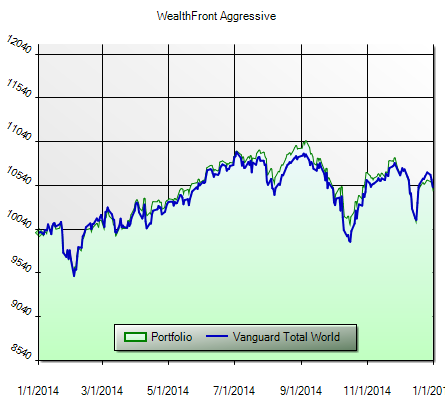

The story from Wealthfront was no different. On their site they make explicit claims about being able to add as much as 4.6% per year, but 2014 was certainly not a year in which that occurred. Their most aggressive portfolio generated a total return of 4.83% with a standard deviation of 11.73. They underperformed the GFAP and the S&P in both nominal and risk adjusted terms.

Make no mistake about these portfolio services. You are not paying for “better” performance. You are paying a premium over a Vanguard Indexing account with the hope that the automation, tax loss harvesting and convenience will make your life easier. And in a year like 2014 that premium actually amounts to much more than few basis points – it resulted in several PERCENTAGE POINTS due to the broad underperformance. All of this might be worth a premium to some people, but in most cases I see no reason why you can’t choose a simple 1, 2, 3 or 4 fund Vanguard account and be diligent about rebalancing once a year. And while these fees are not as egregious as closet index funds they are not much better when compared to other offerings such as Vanguard or Schwab. I can see why someone might be interested in Schwab’s free Robo Advisory offering coming this year or Vanguard’s 0.3% financial planning offering, but many of these other portfolio only services charging higher fees just don’t add value. For the most part, the Robo Advisors look like another Wall Street sales pitch trying to charge a fee for something that you really don’t need to be paying for.

Update – Some readers have noted that the 1 year time frame is too short to judge these firms. I agree, however, we have much more than 1 year performance. After all, they are just tracking broad indices so we can actually backtest their results going back several decades. For instance, the Betterment aggressive portfolio is 95% correlated to the Vanguard Total World Index which can be tracked much further back.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.