I sent this email in response to someone who sent me a not-so-friendly email about the national debt and my response to Stephen Moore’s article from last week. I thought that republishing it might be illuminating for others since these are very common concerns and I seem to regularly receive emails like this from people who have serious concerns over the national debt:

Hi (redacted),

Not sure why the tone of your email is so visceral and personal? Your tone sounds like something that should be directed at someone who might have urinated on your doormat and I can assure you that I did no such thing (at least not during a state of sobriety and consciousness, two states that are not always guaranteed for me). Anyhow…Let me see if I can answer your questions in a friendly manner:

How is the (national) debt going to ever be paid down?

Actually, the debt will NEVER get paid down. Saying that the govt has to “pay back its debt” is like saying that the private sector must pay back its debt. This is true at the micro level, but false in the aggregate. Debt is someone else’s asset. So, to “pay back” the national debt is to reduce non-government’s assets by that much. In a credit based monetary system there is no such thing as aggregate debt repayment. In the long-term, debt is pretty much always expanding because it’s the liability side used to finance our assets (which, if productive, will actually add to net worth over time regardless of debt issuance). In addition, as our population grows we have, at least to some degree, growing needs for government (more policeman, firefighters, etc). So it’s not surprising that our debt has grown over long periods of time.

For some perspective on this consider the US government’s history with debt. Since 1776 we have been in debt almost the entirety of our existence. There was a brief debt repayment in 1835, but the US economy slipped into a depression in 1837 and we quickly went back into debt as tax receipts collapsed. So, we have pretty much been in debt for 230+ years.

This is neither good nor bad necessarily. It really depends on what the debt is being used for. Is it contributing positively to our lives or is it contributing negatively to our lives? Is it contributing to high inflation and is it reducing our living standards? I would agree with many Conservatives that the US govt is issuing debt on many unproductive activities, which is a bit disconcerting. But I would stop worrying about repaying the national debt. It won’t happen mainly because, in the aggregate, debt repayment is actually impossible/unsustainable.

The deficit keeps increasing, and we can’t pay the interest without more debt.

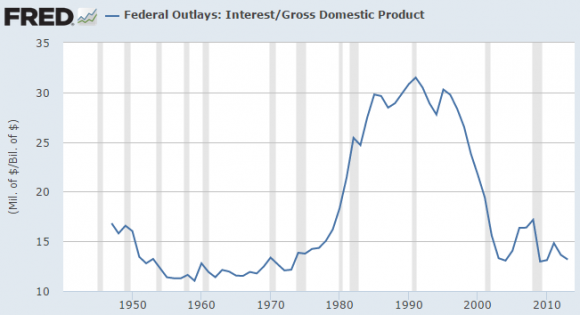

The interest burden in the USA is actually declining as a % of GDP. We pay about $250B in debt service every year. The Federal govt could actually reduce this substantially by reducing the maturity on their debt. They have complete control over their interest costs if they so desire by controlling the duration of their bond issuance. Theoretically, they could just issue 3 month bills at low interest rates in order to keep their own interest costs low. So this too is not a realistic concern.

How are we going to fund all the social spending?

The same way we always have. We will tax and issue bonds. The question is not about whether the govt can “print money” from thin air to funds its operations, but whether this will cause disastrous inflation. (The government doesn’t actually “print money” in any realistic sense so please read more here for details).

What are you going to do, when interest rates rise?

I am going to get in a bunker and prepare for the long dirt nap. Just kidding. The Fed likely won’t raise interest rates until the economy has gotten substantially stronger. And if the economy is getting stronger then stocks are likely performing well and offsetting any downside in bonds. But as I said above, there is no ironclad law that forces the US govt to raise interest rates. Just look at Japan where interest rates have been zero for two decades. A government that is sovereign in its currency, has no foreign denominated debt and a central bank that can issue its own currency does not have to worry about someone else telling them that they need to raise their interest costs. This interest cost is not controlled by “the market”. It is controlled by the monopoly supplier of reserves to the banking system (the central bank) and the Treasury which dictates the average outstanding maturity of the liabilities it issues.

None of this means your concerns are totally unwarranted. I also have my concerns about government spending, efficiency, etc. But I wouldn’t get too bogged down in narratives about “repaying” the national debt and the burden of interest costs. Those ideas are mostly trotted out by people who are trying to scare you into believing their political narrative.

I hope that all makes sense. If you have some more questions feel free to ask. Just leave the personal stuff out of it. Unless it’s funny. I don’t mind personal insults if they’re funny.

Thanks,

Cullen

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.