Warning – this one could put you to sleep if you’re not an econ nerd. I will do my best to translate this into English for those who feel like it’s Chinese.

About 10 years ago a huge war broke out in Post-Keynesian circles. Modern Monetary Theory (MMT) was becoming somewhat popular, but many people (including some rather prominent Post-Keynesians like Tom Palley and Marc Lavoie) thought they were being a bit loose with some of their descriptions. One of the big debates that raged had to do with the way MMT describes private sector saving. To keep things simple, the dispute had to do with the way MMT claimed that private sector net financial saving was composed of government deficits. Basically, their point was to create the view that the only way the private sector can obtain net financial assets is by having its government run a deficit. This and several other points of controversy were central to the many critiques of MMT from within Post-Keynesian circles, which the MMT people found frustrating because PK people should be rather closely aligned with MMT given that much of MMT is similar or based on PK economics.

Anyhow, as MMT has grown in popularity I see the same old debates popping up again (most recently on Scott Sumner’s blog). And I see MMT people making the same old mistakes. So let’s quickly cover some of this so we can hopefully clarify some of the issues at hand.

Randall Wray, an academic proponent of MMT breaks this down clearly: “private sector saving = “net accumulation of financial assets”.

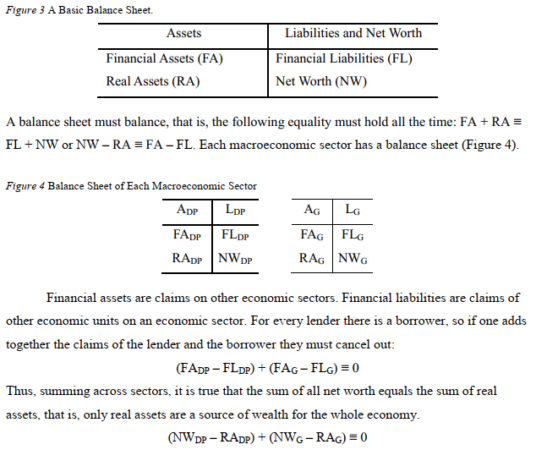

He goes into a bit more detail in a 2012 paper:

(Image 1)

And here’s the crescendo:

“THE GOVERNMENT SECTOR MUST BE IN DEFICIT”. This is MMT in a nutshell. It constructs a view of the world where the government MUST provide a Job Guarantee and MUST be spending in deficit in order to let the private sector net save and MUST spend before it can tax. There are huge problems in all three of those ideas , but let’s just focus on the saving issue.

First – “private sector saving = “net accumulation of financial assets”.

Translation: If you break the economy down into just two components (private and public sectors) then all of the financial assets within the private sector must net to zero. Balance sheets balance. So, image 1 is just describing this fact. When you net out all of the financial assets vs all the liabilities and net worth you get zero. All that’s left over is real stuff like houses and cars. Non-financial assets don’t have liabilities. The physical things we make are all that’s left over after we net out all of the financial assets. That’s simple enough.

So, if you view the economy through a two sector lens then the only way the private sector can have a “net” financial asset is if it comes from outside the private sector. This is where MMT gets sloppy. By netting out of the government sector they are effectively treating it as if it’s a Martian entity. In reality, the private sector creates the public sector and uses its private sector assets to leverage the public sector into public goods and services. Although we aren’t personally liable for their liabilities we are, in aggregate, ultimately liable for the way the government sector impacts all of us just like the shareholders of a corporation are ultimately liable for the actions of a corporation even though they aren’t personally liable for its balance sheet liabilities.¹

Of course, the economy isn’t comprised of two sectors. It is comprised of millions of sectors. If the Cullen Roche sector wants to save then the non-Cullen Roche sector must be expanding its balance sheet. You see, you could net out millions of different entities to support a cherry picked narrative that another sector “must” be in deficit. Cherry picking the “private sector” is the way that MMT depicts things because it supports their policy ideas. But we should be clear – the fact that private sector financial assets net to zero does not mean the private sector cannot net save. In fact, the primary way we net save is against ourselves. The fact that you can aggregate the private sector into one “sector” does not mean there isn’t net saving within the private sector. And that’s the kicker here because, just like we leverage the government from intra sectors, we also leverage millions of other entities within the private sector. The private sector is constantly borrowing and creating corporations to create debt and equity which means that balance sheets are pretty much always expanding and helping to support an ever growing amount of private sector saving WITHIN the private sector. Whether we are better or worse off in the long-run is largely contingent on how we spend for investment and help to create real assets and financial assets that we can then leverage in the future. Sure, the government can help in this process, but there is no accounting tautology by which the government “must” be in deficit at all times.

A simple example might make this easier to understand. Let’s assume Apple Corp is the only corporation in our economy and that they announce a new world changing technology which results in the stock increasing by 50% in anticipation of new net income. When this occurs all of the shareholders of Apple Corp experience an increase in the value of their savings by 50%. This is savings in people’s financial accounts such as their 401ks, pension plans, IRAs, etc that will allow them to draw income (and net saving). What’s happening here is that the value of Apple Corp’s past investment spending has been revalued higher thus adding to savings AND saving. This is why we say that investment adds to savings. There was no need for the government to run a deficit to allow this to happen. In fact, the government didn’t have to do anything at all.

Of course, MMT people would say that corporations are real assets and that the financial assets net to zero, but in reality Apple Corp did not dissave when the value of our savings increased. This is a real net increase in household savings, that can instantly be transferred for spending and it occurs without Apple Corp having to dissave. This is a real increase in net worth and arguably the most meaningful type of change in savings that occurs since investment is the backbone of the entire economy.

This is how the entire economy operates in a nutshell. We borrow money, invest it in things, the value of those things increases, we borrow against the value of those things and the economy grows and grows. The fact that all private sector net saving and savings nets out is immaterial to the fact that we’re actually better off after all this borrowing. But in the MMT world they depict this as though the private sector can only be better off if the government is providing net financial assets.

Now, regular readers will know that I am definitely not against government deficits. I have been a proponent of very large deficits for the entire time I have written this website (10+ years). I think it’s great that the USA has such a dynamic economy that it can afford to have large deficits with low inflation. This allows us to leverage our private sector into many more public services. This is a good thing. But there is no iron clad law of accounting that says the government is the only entity that “must” be in deficit in order for the private sector to net save. Sure, we are generally better off when the government is in deficit. But there is no “must” in here. If you want to argue that there are net benefits to deficits, regulation and government intervention then that’s perfectly reasonable. But this commentary where we can only net save when the government is in deficit is deficient at best and misleading at worst.

This was the crux of the equation we came up with back in 2012. S = I + (S – I) was designed to provide a more pragmatic understanding of what creates private sector saving. Yes, the government can do things that helps to promote economic growth and saving. But we shouldn’t neglect the fact that most of that saving is created within the private sector from the I component. There are millions of sectors netting against one another and the more we invest within the private sector the more we can leverage that output into expanding the government sector. They are not fighting one another as so many people like to make it appear. They are complements to one another. Hence, it is better to say that private sector saving is composed of private sector I plus government sector (S – I).²

Anyhow, I hope this is helpful. I don’t mean to beat up on the MMT people. But I am not here to promote policy and an agenda. I want people to have a better and more pragmatic understanding of money and getting these operational facts right is an important part of that.

¹ – I prefer to think of the government like a Home Owners Association. Home Owners Create HOAs to leverage the aggregate wealth of a neighborhood into some public good. And while the owners aren’t personally liable for any liabilities that the HOA creates they are the ones who must ultimately fund and pay the consequences of those liabilities. The same basic fact is true of a national government.

² – See JKH On Saving and Investment, 2012

NB – I get tired of debating the MMT people because, as mentioned above, those of us who are sympathetic to PK economics find a lot of appealing parts of MMT. But they take generally accurate concepts and then stretch them into these arguments about how the government “must” do this and “must” do that. By stretching the truth they discredit heterodox schools and make it easy for critics like Scott Sumner to poke holes in ideas that could actually be beneficial.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.