My thoughts are all over the place this week. Enjoy.

1) Here’s a fantastic new research note from Vanguard.

Where to start?

First, there’s an interview with Charles Ellis who is just awesome.

Second, they touch on the importance of being globally invested. They even provide a four piece global market portfolio that looks almost identical to my Simple Four Fund GFAP. The note emphasizes the weakness of a home bias (something, interestingly that Bogle recommends and I think is wrong about).

Thirdly, it ends with 4 things investors need to know about high yield bonds. Particularly pertinent in today’s market where the reach for yield has been pervasive.

Go read the note for yourself. Lots of good nuggets of knowledge in there.

2) Is Private Equity a “rigged game”?

Ben Carlson posted a great quote from Chris Sacca, the venture capitalist who funded Uber, Twitter and Instagram. Sacca is talking about how venture capital is a rigged game:

This is a rigged game, right? And I’m just looking to make it even more rigged. For those who don’t know, venture capital is totally unfair. I mean, people give me their money; I draw a management fee off it, so they pay me to take their money and invest it for them. If I make money, then I pay them back the management fee and then after that we split the profits and I get a really big chunk of the profits.

And if I lose money, that’s fine. It doesn’t come out of my pocket. I keep my fee and my investors lose money. That’s how this industry works. That’s bananas. And at some point, it’s gonna break. It’s just an unforgivably unfair, rigged game that’s in favor of the venture capitalist. You’re cash flow positive from day one when you start a venture fund and your downside is incredibly limited by the structure of the fund.

This is part of the problem with performance fees that rely on “beating the market”. The manager is playing a game where the odds are heavily against them over the long-term. The arithmetic of the private equity markets and all markets is simple. In the aggregate we all generate the market return minus taxes and fees. When you consider that the average returns on financial assets are about 6-7% and you lop off 20% for Uncle Sam and then 2 & 20 for your fund manager then you really need a string of huge successes to repeatedly beat the market. The more you can reduce your taxes and fees the better your performance will be on average. It’s not that beating the market can’t be done, but it is very very difficult. So, I wouldn’t say it’s “rigged”. But the likelihood of a market beating payout is heavily skewed in favor of the managers and not the shareholders.

And this is part of the problem with private equity and equity markets in general. Managers who are paid to beat the market will fail more often than they succeed. But there will be a certain number who win consistently. The problem is, many of these managers will crash and burn thereby taking their investors down with them while a lucky minority will thrive.

In my view you should treat your savings like it’s your actual savings rather than this inevitable sort of gambling account. As I say, your investment portfolio is actually a savings portfolio. Allocate your savings prudently so you can increase the odds that you’ll have certain quantities at certain points down the road. If you want to make a big big bet on private equity then invest in yourself. As I said in my book, there’s no better investment in the world.

3) How’s this for an epic fail?

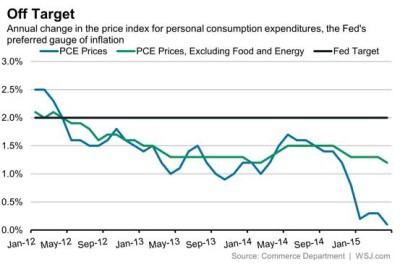

This month marks the 36th straight month in which the Fed has missed its inflation target.

Of course, New Monetarist Paul Krugman (you have to be a special kind of nerd to understand what I did there) and the Market Monetarists would argue that the Fed just hasn’t been emphatic enough. They haven’t set “permanent” expectations. Well, the “do whatever it takes” Central Bank policy has already failed in Japan where inflation is fast on the decline again, has failed in Europe and I’ve shown that the theory doesn’t at all reflect the real world.

At what point do we begin to consider that Monetary Policy and pumping reserves into the financial system just isn’t that impactful? Or are we destined to continue trying various Monetary Policy experiments until we’ve worn out all of our options? How many times does Monetarism have to fail and be rebranded before we move on?

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.