John Templeton once said that the four most dangerous words in investing are “it’s different this time”. But I have to disagree with this statement to some degree because I think each economic cycle is, to SOME degree, its own cycle and has elements that are always different from past cycles. And one common refrain today is how we might be experiencing something like the 70’s in the not too distant future (see here for instance). It’s an intriguing idea given the economic malaise and the stagnant economy. Today’s environment sort of gives the feeling that we might be on the verge of a real stagflation where growth is moderate and inflation is high. But I really don’t think that’s the case. And there are five main reasons why.

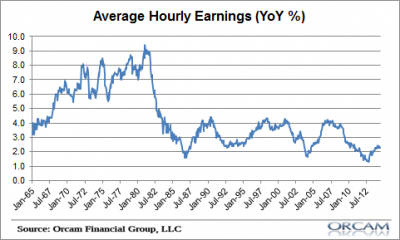

First, the labor class has far less negotiating power than it did 40 years ago. Regulations, union weakness, innovative efficiencies, cheap labor alternatives, inequality and the growing power of corporate America have all put the capitalist class in the driver seat. And that means wages are likely to remain low. I keep hearing stories about how wage growth is on the verge of an upside explosion, but in an economy where there is so much slack, so much cheap labor, so much demand for labor and so little labor class negotiating power I just don’t see how the pieces add up to substantial wage growth there.

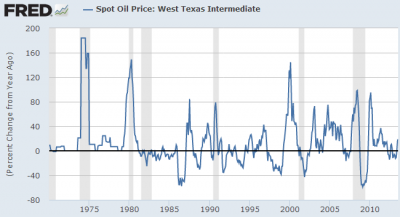

Second, the 1970’s were a period of tremendous oil price shocks and commodity scarcity. With the exception of 1997, we’ve never had oil shocks quite like the 1970’s. That doesn’t mean it can’t happen again, but the growing abundance of energy alternatives and US oil production make this a far less likely event than we were likely to experience in the 1970’s. More importantly, the excess abundance of oil and commodities in general, makes this a far different environment.

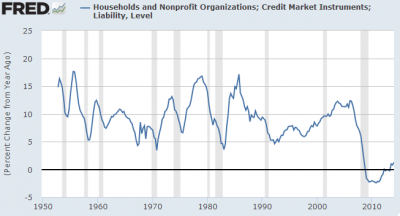

Third, the 1970’s were a period of tremendous credit expansion. Many people don’t realize it, but the 1970’s were a period of decent economic growth and robust credit expansion. In fact, it was a period of sustained double digit credit growth in household debt. Today’s environment is nothing like this. After the credit bust lending standards are tighter and demand for debt is far lower. This period looks nothing like the 1970’s with regard to demand for loans.

Fourth, demographic trends are not inflationary. One of the lessons from Japan is that a country with a shrinking population is unlikely to experience a high inflation. This makes perfect sense since population growth is a key element to economic growth. When your labor force and population are shrinking you have fewer workers who need to achieve more. All else equal, a shrinking population should lead to lower growth and lower rates of inflation. The demographic trends in the USA are not as negative as the case of Japan, but they aren’t consistent with booming growth either. The US labor force is shrinking as the population ages and the growth rate slows. This is a huge macro headwind that is unlikely to change any time soon.

Lastly, tech trends are putting increasing downward pressure on prices across the board. We are seeing this not only in the tech space, but even the food and energy space where prices have declined substantially due to the abundance of these resources (thanks largely to better extraction technologies). This is perhaps the most disinflationary trend of them all and while tech growth is unlikely to be exponential it is also unlikely to stop any time soon.

This isn’t the 70’s in my opinion. This is its own unique economic environment and one that’s not likely to lead to a stagflation. The much more likely case is a continued muddle through or even a malaise. But it won’t be inflationary. In fact, I still fear that disinflation with an outside chance of deflation is the greater risk….

This article was updated in 2017 from 3 to 5 reasons.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.