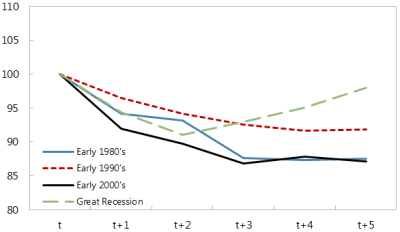

The death of manufacturing in the USA has been greatly exaggerated in recent years. This recent piece in VOX highlights some of the stats. The most interesting of which is the current manufacturing recovery relative to previous manufacturing recoveries:

Figure 1. Manufacturing rebound by recession (Index, 100=year before recession, index of the share of manufacturing value added to total output)

That’s pretty interesting. But what’s been driving this recovery? According to the authors the recovery has come from three sources primarily:

Three main conditions have been highlighted as drivers of a US manufacturing revival:

- The US real effective exchange rate has depreciated (become more competitive) over the last decade. Since the recession, the weak level of demand and high cyclical unemployment have contributed to a weaker US dollar, in particular against emerging-market currencies.

- The price of labour in the US has decreased relative to emerging markets. The significant relocation of production to emerging Asia during the 1990s and the 2000s and high unemployment in the aftermath of the Great Recession have resulted in lower wage pressures and favourable changes in unit labour costs in the US over the last decade.

- There has been a significant reduction in domestic energy prices following technological breakthroughs in the exploitation of shale gas. In particular, recent advancements in drilling technology (including shale gas fracking) resulted in a significant increase in natural gas production in the US and led to a reduction of domestic prices, which are currently about one-fourth of those in Asia and Europe (Figure 5).

I think that’s pretty accurate. And what’s even more interesting to think about is the potential for further energy innovation in the coming decades. Or even better, just imagine if our policy makers decided to actually do something about the persistently strong dollar? These are big time macro trends worth keeping a close eye on.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.