I know it’s popular these days to declare that the markets are some “efficient” all knowing entity and that forecasters are useless. But I just don’t buy that nonsense. I think we’re all implicit forecasters when we allocate assets and some people do it by forming a well informed and probabilistic approach while some others just (generally) buy a stock heavy allocation, “stocks for the long run” and hold and hope that their implicitly bullish forecast is right. Making informed forecasts about the future isn’t just necessary, it’s the only intelligent way to allocate assets. That said, last year around this time I did a quick Q&A on the economic and market outlook so let’s see how I did:

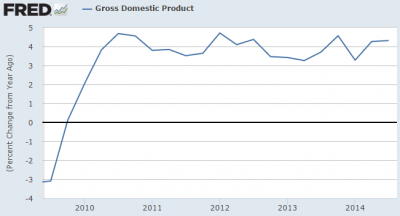

1. Will the economy accelerate to above-trend growth?

I said:

Although the US economy has made tremendous progress in recent years and the private sector is improving, I think it is highly unlikely that the credit environment is strong enough to sustain high historical levels of growth.

Verdict: A-. This was not a hard question. Given the structural headwinds coming out of the crisis there was little momentum in the US economy that would lead to above trend growth. And despite the strong quarterly readings in recent quarters the nominal growth has been just so so. My overall reading on the US economy has been pretty spot-on for the last 4 years, but I think the most important part of my thinking has been the recession calls that I have consistently shot down over the years. The US economy is healing, but slowly.

That said, I also thought the US economy was “hotter than it looks” as I discussed in this Q1 research piece. So while the US economy has grown at sub-par levels it’s actually been much better than the mainstream media and general public perceive.

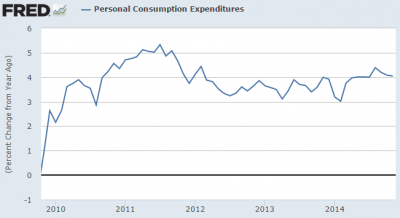

2. Will consumer spending improve?

I said:

Consumer spending is likely to continue stagnating.

Verdict: B+. Personal consumption expenditures improved slightly in 2014, but weren’t exactly anything to write home about.

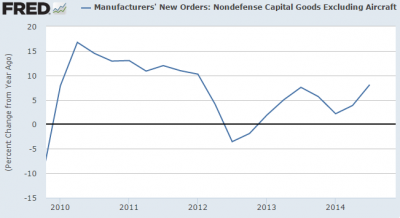

3. Will capital expenditures rebound?

I said:

Corporations are increasingly picking up the slack in the US economy and as has been historically true, as we enter the latter stages of the business cycle, capital expenditures are picking up.

Verdict: B+. Capex picked up only marginally in 2014, but was choppier than I might have expected.

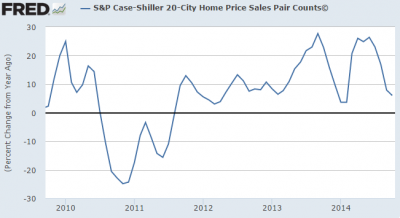

4. Will housing continue to recover?

I said:

National housing prices have risen too far too fast in many areas of the USA and should see much more modest improvements in the coming years. Many markets that have boomed in the last 12 months (such as San Francisco, San Diego and Phoenix) could be at risk of substantially lower year over year gains. I do not foresee national declines, however.

Verdict: A. This was pretty much spot on. Prices declined on a year-over-year basis around the country, but did not decline. Housing proved strong, but weaker than 2013.

5. Will labor force participation rate stabilize?

I said:

The improvement in the economy combined with the structural negatives do not leave me entirely optimistic that the labor force participation rate will see material improvement in 2014.

Verdict: B+. The labor force participation rate declined from 63 to 62.8. Pretty boring stuff.

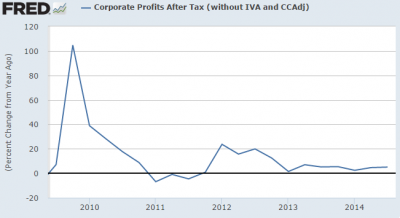

6. Will profit margins contract?

I said:

Profits as a whole should continue modest single digit expansion in 2014, however, I would not expect the robust margin expansion of the last five years to continue. The likely risk to profit growth and margins is to the downside, however, as of Q1 2014 I do not see substantial negative risk. Rather, the more likely scenario is moderating margin expansion and modest single digit profit growth.

Verdict: A-. Corporate profits averaged a modest single digit growth rate of 4% in 2014. Margins averaged 11% in 2014 relative to an average of 11.85% since 2009.

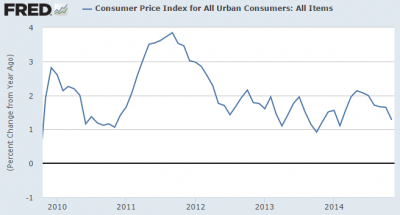

7. Will core inflation stay below the 2% target?

I said:

At 1.7% core inflation does not have to climb much higher to hit the Fed’s target rate of 2%. I would expect core inflation to remain low as consumer demand for shelter, autos and other core items remains tepid. There is, in my opinion, very little chance of high inflation in 2014.

Verdict: A-. I’ve been on the “low inflation” train ever since the crisis started in 2008. This year was no different. In fact, a pretty strong disinflationary trend took hold in the second half of the year. High inflation has been nowhere in sight. Anyone whose portfolio has been positioned for high inflation in the last 5 years has experienced a disastrous period of underperformance.

8. Will QE3 end in 2014?

I said:

QE is likely to taper in increasing increments during 2014, but I do not think the Fed will pull the punch bowl away just yet. We are more likely to see a slow and methodical approach to tapering. Given the likelihood for another year of below historical levels of growth and low inflation, I think there’s a high probability we could still be talking about tapering 12 months from now.

Verdict: C-. This was not right and not totally wrong. Tapering did prove gradual in 2014, but QE3 came to an end in 2014. In fairness, I did update my view later in the year noting that the end of QE3 was indeed going to happen and would be inconsequential for the most part. Still, not a good call a year in advance.

9. Will the market point to the first rate hike in 2016?

I said:

I am going to go way against the consensus here and argue that the next recession is likely to occur before the next rate hike. ZIRP is here to stay and likely means QE is the policy variable of choice for the Fed in the coming few years.

Verdict: A-. In a Q1 research piece I said that 2014 was a time to be “more bullish” on bonds as a whole:

Therefore, I do not think it’s prudent to be overly bearish on fixed income as a whole. A moderately long duration is likely to perform well in 2014 given that inflation is likely to remain low and the economy won’t be excessively strong. Most importantly, I think that the Fed has eased investors into digesting the

taper and the majority of the price adjustment off the May 2013 lows has probably been accounted for. So while there is some potential for downside risk in fixed income in Q1 or the first half of 2014 I do not think the risks to the downside are as great as they were in 2013. Therefore, I would actually be more

bullish about fixed income as a whole.

This was very much against the grain where most analysts expected interest rates to rise and bonds to come under pressure. And as bonds outperformed every other asset class in nominal and risk adjusted terms in 2014 it proved to be a very good call.

I said some stuff about the secular stagnation theme that was inconsequential. In general, my bullish cyclical stance on stocks, low interest rate & low inflation calls were right for the most part. This sort of a general macro perspective has led to some high probability predictions about the macro economy and asset classes.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.